It seems to be evidently clear that with the current shift in geo-political alliances and economic slowdown, we can notice a general pattern where the major economies are starting to back out of the dollar-dominated global system and form their bloc of economic dominance.

The U.S. dollar’s prominence in global affairs is influenced by economic factors and geopolitical forces, posing a danger to its dominance in the currency world. Some nations have pushed to further limit their reliance on the dollar due to U.S. sanctions imposed in reaction to Russia’s invasion of Ukraine.

The co-director of the Institute for the Study of Global Security claims that the United States has been “very trigger-happy” with its economic sanctions, and that central banks may seek to diversify their foreign reserve holdings rather than relying heavily on the U.S. dollar.

Earlier this month (March, 2023), President Vladimir Putin stated during talks with his Chinese counterpart Xi Jinping that Russia is ready to increase settlements in yuan in its foreign trade.

“We are for the use of Chinese yuan in settlements between Russia and the countries of Asia, Africa, and Latin America. I am sure that these forms of settlements in yuan will be developed between Russian partners and their counterparts in third countries,” RT News quoted Putin as saying.

The latest data from the Bank of Russia shows that yuan is now a major player in the Moscow’s foreign trade, with its share in the country’s import settlements jumping from 4% in January 2022 to 23% by the end of last year.

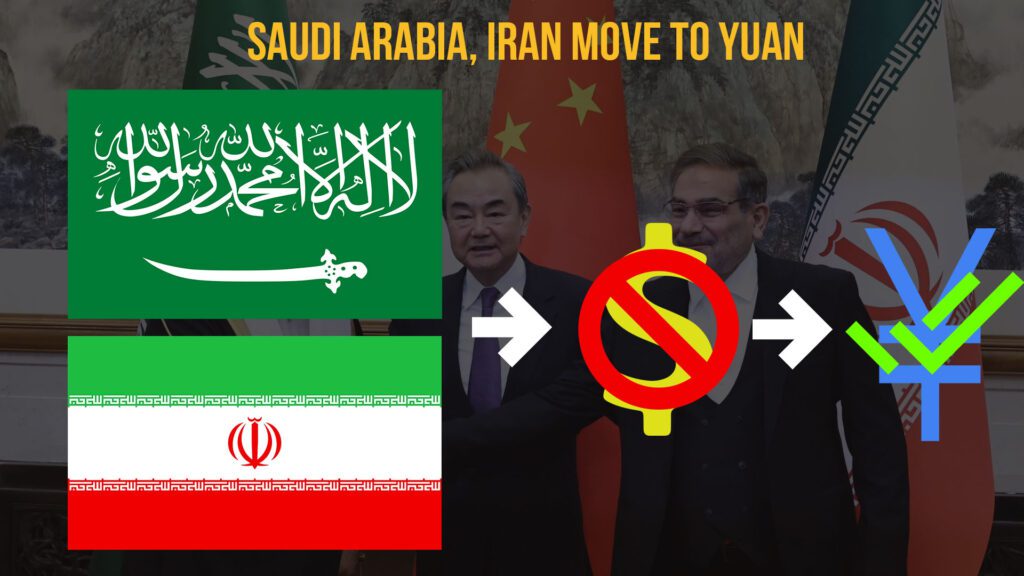

According to analysts, Saudi Arabia is also actively negotiating with Beijing to price part of its oil supplies to China in Yuan. This would further weaken the US dollar’s dominance of the world petroleum market and signal another turn by the top crude exporter towards Asia.

China buys more than 25% of the oil that Saudi Arabia exports. If priced in yuan, those sales would boost the standing of China’s currency. The Saudis are also considering including yuan-denominated futures contracts, known as the petroyuan, in the pricing model of Saudi Arabian Oil Co., known as Aramco. (Wall Street Report).

Also, it must be noted that Iran remains one of the major oil exporters to China. Ehsan Khandouzi, Iranian Minister of Economic Affairs and Finance, emphasized that the Central Bank of Iran (CBI) is conducting discussions to expand trade with China in RMB Yuan with the help of the Chinese government. If an agreement is reached, instead of the US dollar and Euro, China’s RMB Yuan will be used wherever possible in bilateral trade between Iran and China.

Iran’s non-oil trade turnover with China amounted to US $25.3 billion, during the first 10 months of the current Iranian year (March 21, 2022, through January 20, 2023). China ranks first in Iran’s non-oil trade over this period. Of that trade, Iran exported non-oil products worth US$12.8 billion to China, an increase of 10% compared to the same period in the last Iranian year. Iran imported goods worth about US$12.7 billion from China over the same period, an increase of 33% compared to the same period last Iranian year. (Silk Road Briefing Report)

Furthermore, India has joined on board as more countries are ready to deal in Indian Rupees. “The Reserve Bank of India (RBI) has announced 18 countries to open Special Vostro Rupee Accounts (SVRAs) for settling payments in India. They include Botswana, Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Russia, Seychelles, Singapore, Sri Lanka, Tanzania, Uganda, and the United Kingdom,” stated Union Minister of State for Finance Bhagwat Kishanrao Karad. (The Hindu)

Additionally, there was also an announcement by Brazil and Argentina that they, too, would be looking to use a new currency for bilateral trade.

When asked about the implications of the US de-dollarization in a recent interview by FOX News, former assistant Treasury secretary Monica Crowley responded that it would be disastrous since the US dollar has long been regarded as the world’s reserve currency. The dollar has been the safe haven since the end of World War II, first supported by gold, the power and economic strength of the US, and the fact that oil had always been exchanged in dollars; therefore, if this stops, the US currency will also disappear. This privilege of having that position has, in my opinion, been abused by our reckless fiscal and monetary policies over the past few years.

“And now that the Ukraine War, Biden’s weakness, and his war on American domestic production have all coincided, we have a perfect storm of economic adversaries, mainly China, establishing a new economic bloc. As a result, nations like Saudi Arabia are now considering using alternative currencies to exchange oil. If that were to happen, the world economy and the US economy would collapse, and we would lose our place as a dominant economy and superpower” she further added.

It seems to be evidently clear that with the current shift in geo-political alliances and economic slowdown, we can notice a general pattern where the major economies are starting to back out of the dollar-dominated global system and form their bloc of economic dominance.