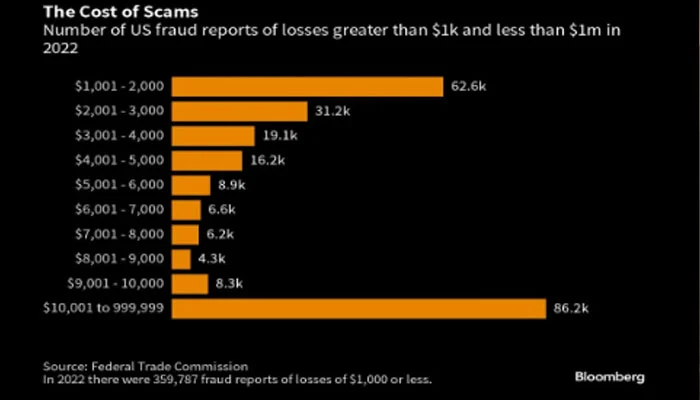

Consumer losses from fraud in the US amounted to nearly $8.8 billion last year, a 44% increase from 2021

The rise of advanced scam technology, fueled by artificial intelligence (AI), has become a pressing concern for regulators, law enforcement, and the financial industry as cybercrime scam costs are projected to surpass $8 trillion in 2023 and reach $10.5 trillion by 2025, surpassing Japan’s economic output.

These technologies, which include computer-generated children’s voices and masks created with social media photos, are already being exploited by criminals to deceive unsuspecting consumers.

US Federal Trade Commission Chair Lina Khan has raised alarm over the use of AI to escalate fraud activities, urging heightened vigilance from law enforcement.

A significant rise since 2021

Even before AI became accessible to the masses, the world faced an escalation of financial fraud. In the US alone, consumer losses from fraud amounted to nearly $8.8 billion last year, a 44% increase from 2021, despite significant investments in detection and prevention measures.

Major banks like Wells Fargo and Deutsche Bank warn that the impending fraud boom poses one of the most significant threats to the financial industry. Beyond the financial losses, the industry risks losing the trust of affected customers.

An “arms race” is underway, according to James Roberts of the Commonwealth Bank of Australia, who leads fraud management.

Scams have an extensive history, but innovations in technology, such as AI, have made them more pervasive and sophisticated. The adoption of online banking accelerated due to COVID-19 lockdowns, providing both convenience for financial firms and opportunities for scammers.

Educating consumers

Efforts to combat these scams involve educating consumers about risks and investing in defensive technology. Banks are developing tools to spot suspicious transactions, analyze unusual mouse activity, and detect synthetic images. However, criminals constantly adapt, necessitating the ongoing evolution of defence mechanisms.

As technology evolves, lawmakers grapple with the question of liability, and industry leaders seek to distribute responsibility across financial institutions and tech firms.

Challenge to banks

The challenge banks face is enormous. For instance, the Commonwealth Bank of Australia monitors around 85 million events daily in a country with a population of just 26 million. While technological solutions offer hope, fraud experts acknowledge that the problem is not fully solvable and draw parallels to the fight against drug-related crime. Ultimately, fraud remains an ongoing battle where vigilance, innovation, and cooperation among stakeholders are crucial.