The just-concluded Yellen’s China trip and all the concrete, problem-oriented dialogues with the Chinese counterparts are the right steps in the right direction.

The recent China Trip by Janet Yellen, U.S. Secretary of Treasury was another major step in the course charted by the “San Francisco Vision” reached by Chinese President Xi Jinping and U.S. President Joe Biden last November.

During the 6 days China trip, Yellen met with U.S. business representatives in Guangzhou and Chinese government leaders in Beijing, discussing a wide range of global and bilateral economic, financial and business issues.

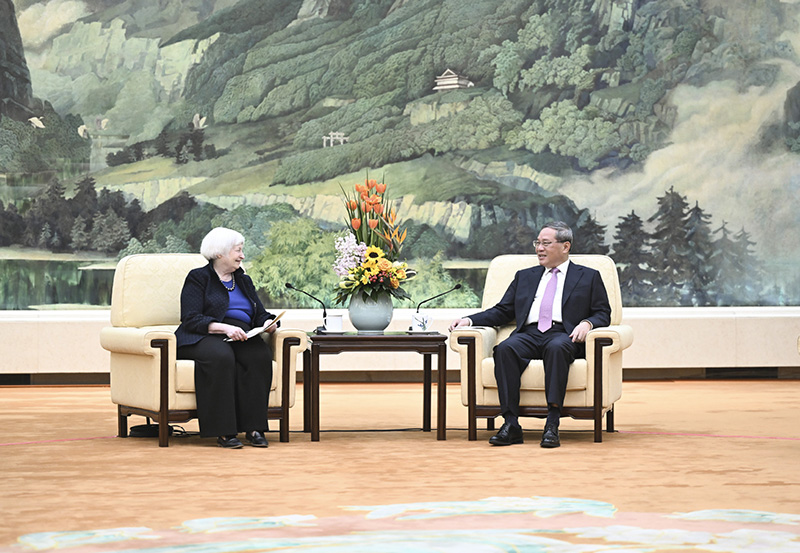

Chinese Premier Li Qiang on Sunday met with Yellen in Beijing. Noting that the China-U.S. relationship is beginning to stabilize under the strategic guidance of the two heads of state, Li said that China hopes the two countries will be partners rather than adversaries, with mutual respect, peaceful coexistence and win-win cooperation. It is hoped that the U.S. side will work with China to continue implementing the important consensus reached by the two heads of state, and translate the San Francisco vision into reality, he said.

Yellen said that the United States appreciates the progress made in U.S.-China economic dialogue and cooperation, does not seek “decoupling” from China, and stands ready to work with China to implement the important consensus reached by the two presidents in San Francisco.

This was Yellen’s second China trip following her first one in July 2023. Almost simultaneously, the first China-U.S. trade and commerce working group meeting was held in Washington, D.C. on April 2-5, 2024. Initial positive results have loomed up following the continuous implementation of the bilateral high-level government dialogue mechanism over the year.

According to China customs data, China-U.S. two-way trade during Jan.-Feb. 2024 saw a slight positive growth of 0.7 percent over the same period of 2023. In contrast, it fell drastically by 17.4 percent y-o-y during Jan.-Feb. 2023. The U.S. official data show a similar pattern. The U.S.-China two-way trade during the first two months of 2024 was down only 1.9 percent y-o-y, compared to a 17.2 percent fall y-o-y during Jan.-Feb. 2023. There was also a new rush of American business leaders to China during the China Development Forum in late March. All the recent developments have shown that China and the U.S., as the world’s two largest economies, are well connected in the global supply chain, making the de-coupling unlikely to happen.

Yellen’s China trip focused on macro-economic and financial matters, covering global collaboration and bilateral relations.

Regarding the global collaboration, both China and the U.S. talked about macro-economic policy coordination for supporting the global economic recovery and responding to global financial risks, debt distress in low-income developing economies, and climate change. Both sides have found the dialogue imperative and fruitful.

With regard to the bilateral issues, more differences were under the spotlight, including, among others, U.S. allegation of China’s excessive capacity in electric vehicles, solar panels and lithium cells and its disturbance on the global markets and the U.S. industries, and its allegation of China on the government subsidized industrial policies, and unfair treatment to American businesses in China. China, on its part, has strongly refuted the allegations.

World output of the new energy vehicle (NEV) reached 14.65 million units in 2023, with China accounting for 9.49 million, two-thirds of the total, compared to 2.95 million in the U.S. and 1.47 million in Europe. Nonetheless, over 87 percent of the total was sold in China’s domestic market, leaving 1.2 million units for exports. The top three markets were Belgium, Thailand and the UK. China NEV exports to the U.S. were minimal. There are no adequate facts showing that U.S. automotive industry and its workers had suffered losses from China’s NEV exports. However, both sides agreed on continuous dialogue on this issue.

Total world NEV stock reached 26 million in 2022. With fast NEV output increases in 2023 and the following three years, total world NEV stock could hit 100 million units by 2026, according to a Bloomberg report. It will be, however, only about 8 percent of total world automotive stock. As the average oil consumption per unit of automobiles is approximately 1.8 tons per year, 100 million NEV could save 18 million tons of oil use, an integral contribution to meeting the Paris Agreement goal of reducing CO2 emission. Bloomberg has also estimated that the total world NEV stock by 2040 could hit 700 million units. In other words, the world annual NEV output needs to hit 40 million every year in the next 16 years to meet the expectation. Hence, China’s annual NEV output of 10 million is far from “overcapacity”, rather, it is a major contribution to world common efforts fighting climate change. In this regard, China and the U.S. should join hands in NEV development in both countries, based on an open, non-discrimination principle, reaping benefits for both countries, including the American families and workers, instead of blaming China only.

Similarly, the dialogue should also cover industrial policies, subsidies and restrictive trade measures. Before leaving for China, Yellen asserted strongly China’s industrial subsidies in an interview with MSNBC, blaming Chinese cheap goods for “flooding the markets”, and causing “unfavorable impacts” to the U.S. and its allies. In fact, Chinese exports to the U.S. in 2023 were 20.7 percent lower than that in 2018, according to U.S. official statistics. During the same period, Vietnamese exports to the U.S. more than doubled with their product prices apparently lower than those of China. Chinese products are thus neither flooding the U.S. market, nor the cheapest.

On its part, China also raised its concerns on the U.S. unilateral tariffs and restrictions on Chinese exports and high-tech export restrictions on China during the first China-U.S. trade and commerce working group meeting held in Washington, D.C. on April 2-5, 2024.

The above-mentioned major differences, among others, show the utmost importance and urgency of keeping high-level official dialogues and shooting concrete issues one by one, if both sides want to keep their bilateral business relations stable and improving. The just-concluded Yellen’s China trip and all the concrete, problem-oriented dialogues with the Chinese counterparts are the right steps in the right direction. Both China and the U.S. should continue their efforts to manage differences and strive for a sustainable upturn in the bilateral economic and business relationship, benefiting our two peoples and the world at large.

Source: China Focus