According to the latest data in the CNBC Supply Chain Heat Map report, China released its latest economic data where the figures do not show a healthy state of affairs, as the economy is struggling domestically and internationally. The main factors attributing to its slowdown can be China’s zero-covid policy and its ongoing trade conflict with the US.

Undoubtedly, China’s zero covid policy is a significant factor in the erosion of its long-term dominance in global trade. “China’s Zero Covid approach is impacting production and manufacturers are seeking for alternatives to the current ‘factory of the world’,” said Antonella Teodoro, senior consultant at MDS Transmodal.

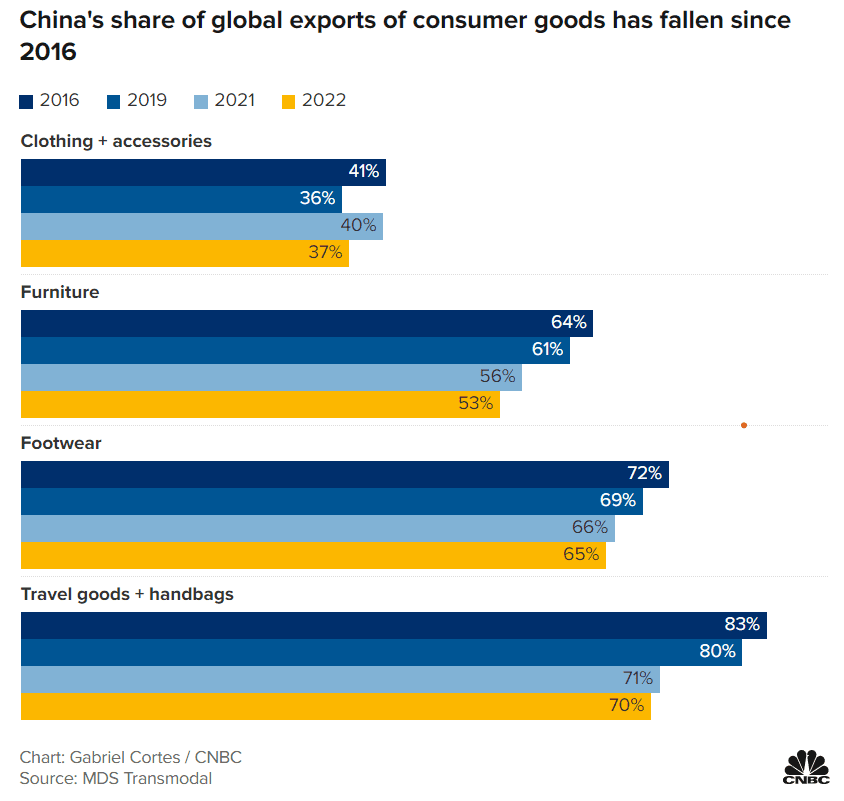

China has lost ground in profitable consumer categories like the furniture, clothing, accessories, footwear, travel goods and products industries, as there has been a significant decline in production costs since 2016, which has had an influence on the global industrial economy.

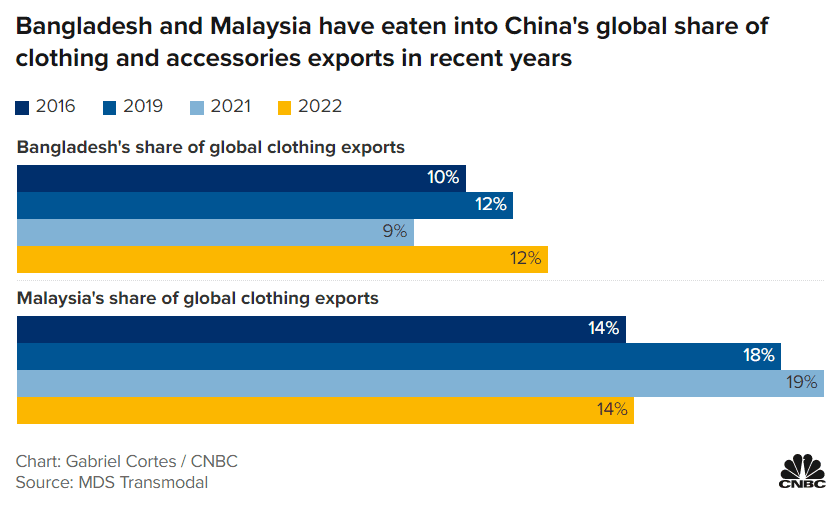

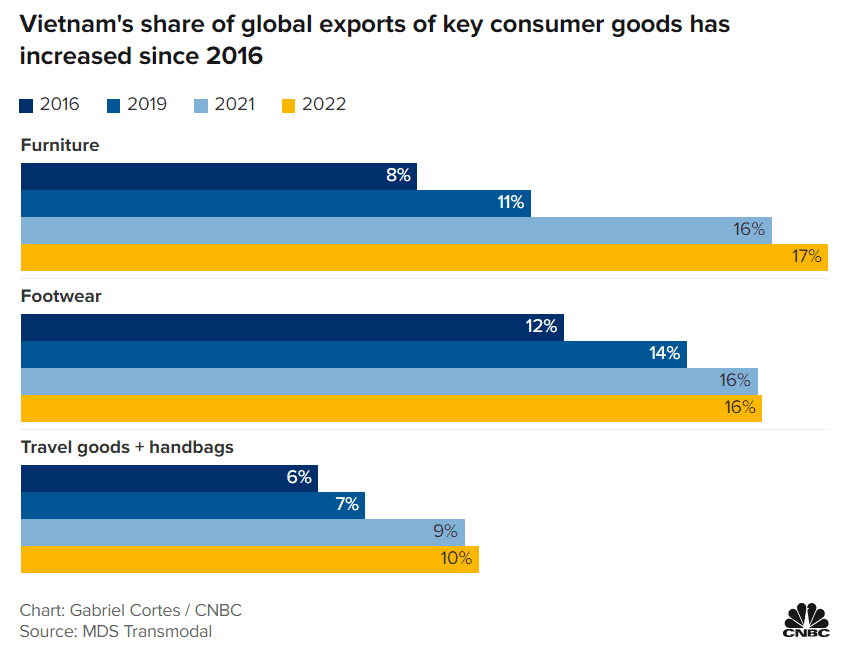

While Vietnam has invested in Metal manufacturing products, Malaysia and Bangladesh have taken over the apparel manufacturing sector. From 2016 to present, Malaysia and Bangladesh have merged into the apparel and accessories domain, what once used to be part of China’s expertise. Since 2018, US trade tariffs have also been looking for alternate sources in China for manufacturing and disruption in costs. This could also be due to the heavy supply demand from other neighboring countries.

A rise in intra-regional trade in Asia has been observed for manufacturing especially in Vietnam and other southeast Asian countries. In the years before to Covid, the competition had grown fierce. Vietnam has taken the lion’s share of the manufacturing trade away from China with an almost 360% increase in far-distance trade since 2014. “Vietnam’s close proximity to China and cheap labor are reasons why Vietnam is considered a suitable alternative”, stated Teodoro.

There has also been a decline in shipping orders as seldom do they make it through. A pre-2021 monthly vessel capacity of around 11.2 million TEU dropped to 8.6 million TEUs departing Chinese ports in September, representing a 23.2% decrease in vessel capacity leaving Chinese ports, according to Josh Brazil, vice president of supply chain insights for Project44.

Cargos arriving from China to US are expected to dramatically decrease from 50 to 40% most likely in November.

In the next few months, it will be interesting to see how China can reemerge in the global market and regain its position as one of the leading manufacturers. However, there is a concern that with the re-election of President Xi, China will continue with its ideological policies at the cost of economic growth.